We use a messaging service to text and email you about:

- yearly reviews on discount and exemptions

- unpaid direct debits, or

- due or overdue payments.

This service can prevent statutory recovery notices being issued to you. It may help you avoid paying expensive costs.

The service is offered to prevent customers from falling further into arrears, please do not rely on it. It is your responsibility to maintain the instalments due on your account in line with your bill. Failure to do so may result in recovery action being taken.

What to expect so you know it’s genuine

We will contact you through the contact details we have on file. If we have:

- your email address, we will email you

- your mobile number, we will text message you

- both your email and mobile number, we will send you both an email and a text message.

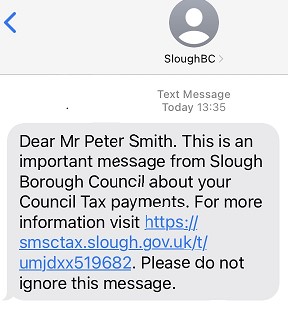

Text messages will come from “SloughBC”. Please do not reply back to the text messages, it can't receive texts. You will be asked to verify who you are through this text.

Emails will come from counciltax@mail.ctax.slough.gov.uk. To reply back please use the "Reply" button within the email.

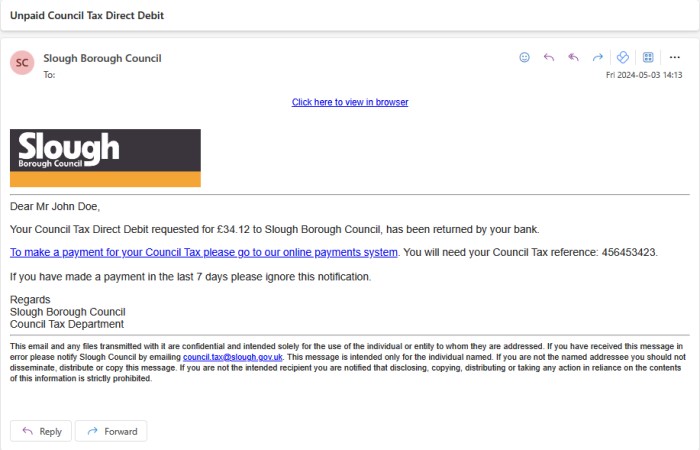

Emails

Emails you get from us will address you with your title, first name and surname. And will ask you to use the link within the email and follow the instructions given.

Text messages

The first message

The first text message will address you with your title, first name and surname. It will tell you what the message is about and give a link that takes you to the verification screen so you can verify who you are.

The link will be a unique web address which will start with https://smsctax.slough.gov.uk/t/ followed by a series of letters and numbers.

When you access that link you will be taken to the verification screen.

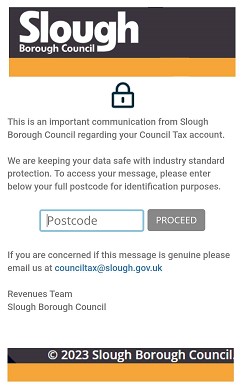

Verification screen message

At the verification screen you will be asked to verify yourself by putting in your postcode.

Incorrect postcode message

If you entered in an incorrect postcode then you will receive a text message: “Sorry we don’t recognise you at this postcode. Please try again”.

After three attempts on the postcode

If you enter the postcode incorrectly three times, then your access will be blocked for 30 minutes. After 30 minutes you can try again. If you enter the postcode incorrectly three times, then your access will be blocked for 30 minutes. After 30 minutes you can try again. If this attempt is incorrect too, then you will get another message "You have been locked out for unusual activity please contact us to get access counciltax@slough.gov.uk. Please include locked out and your council tax reference number to the subject field."

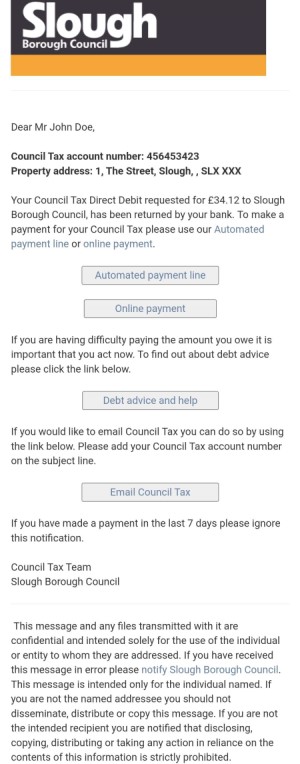

Action to be taken message

When you have passed the verification process (entered your postcode). You will then get another text message with details of what to do next, such as:

- make a payment or

- respond to a survey.

If you feel concerned

If you are still concerned about these emails and text messages, please email counciltax@slough.gov.uk and include your 8 digit council tax reference number in the subject line.