This is a guide to the different sections of your bill. We have broken it into 5 sections from top to bottom.

- top of the bill

- address and account information

- further details

- breakdown of what makes up your council tax

- instalments.

Section 1: Top of the bill

The top part of the bill gives the council website address, and a barcode which you can use to pay your council tax at a Payzone location.

Section 2: Address and account information

This section shows the name of the person responsible for paying the bill and the billing address on the left.

On the right you will see 3 pieces of information:

- date the bill was printed. Any payments made after this date will not be on the bill

- your Council Tax account reference number. You will need this number if you want to ask us about your bill or when managing it onlline

- the address that you are paying council tax for, if it is different from the billing address. if it is the same as the billing address, this will be blank.

Section 3: Further details

Here you will find:

- the full dates that the bill covers

- the council tax band of your home - in this example it is band B

- your method of payment for the financial year 2025-26 - in this example direct debit.

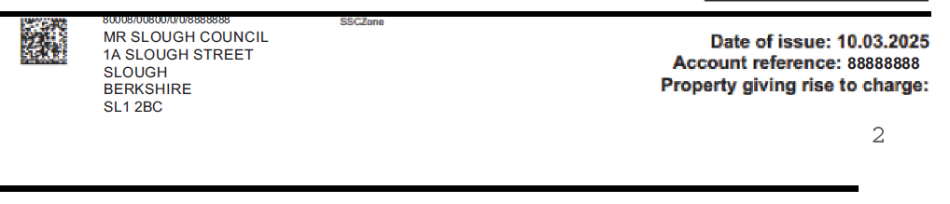

Section 4: Breakdown of your council tax

This section shows what makes up your council tax payment. You do not pay all the of the different lines separately. They combine together as your council tax bill. Some items are listed with a minus in front of them. Any figure with a minus in front of it is taken off your total charge.

It is made up of the following:

- Slough precept payment excluding any parishes (Wexham, Britwell and Colnbrook), but including Adult Social Care

- Police & Crime Commissioner for Thames Valley precept for Slough 2025/26. More details can be found on Council Tax page - Thames Valley PCC

- Royal Berkshire Fire & Rescue Authority precept for Slough for 2025/26. More details can be found on Financial Transparency - Royal Berkshire Fire and Rescue Service

- parish precept - if you are a resident in one of our parishes - Wexham, Britwell and Colnbrook - your bill will show an additional charge for the parish. This is highlighted in yellow for Wexham in the above image as an example.

- discounts or reductions - this details how your Council Tax charge is affected by any discounts that are applied to your account. Some of the most common things that will affect your bill are:

- Single Person Discount – a 25% discount that you get for being the only person in the property eligible to pay Council Tax.

- Council Tax Support – any Council Tax Support (CTS) that you are entitled to will be used to reduce the amount that you pay.

- Balance due: this is the total amount that you need to pay.

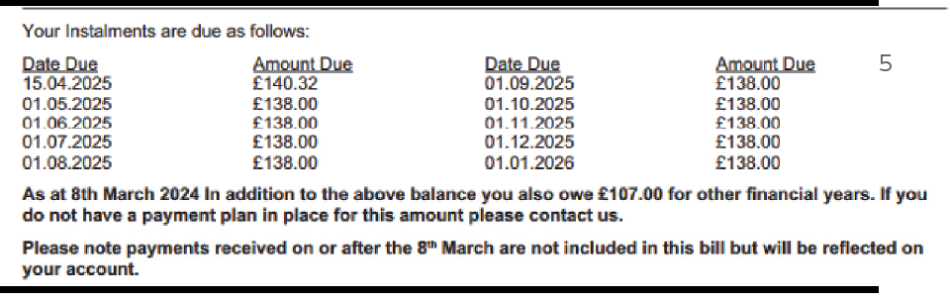

Section 5: Instalments

This shows the monthly payments that you need to make and the date that they need to be made by. If you pay by Direct Debit the amount shown will automatically be taken from your bank account on your chosen date.

Any arrears or amounts outstanding from previous years are not included in these instalments and should be paid as previously arranged.