How council tax and business rates are spent

2025/26

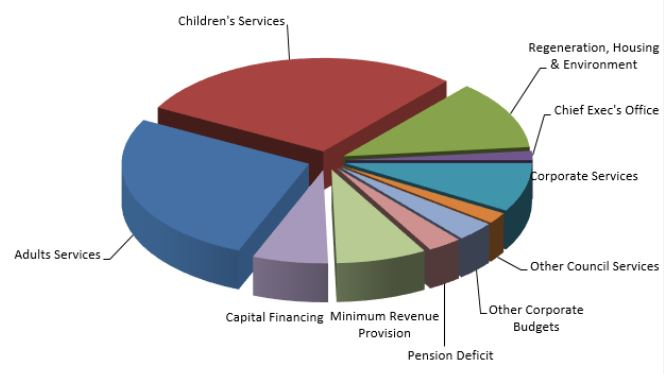

The graph shows how every £1 budgeted is spent:

- 27p pays for Adult Social Care services

- 29p pays for Children's Services

- 12p pays for Regeneration, Housing and Environment services

- 2p pays for Chief Exec's Office

- 8p pays for Corporate Services

- 2p pays for other Council services

- 3p pays for Other Corporate Budgets

- 3p pays for the Pension Deficit

- 8p pays for Minimum Revenue Provision

- 6p pays for Capital Financing

Where does the money come from?

The budget required to support the Services provided by the Council is £175.728 million. The funding sources for the council budget are detailed below:

| Source of funding | 2024/25 £000 |

2024/25 % |

2025/26 £000 |

2025/26 % |

|---|---|---|---|---|

| Total Budget Requirement | £160,202 | 100% | £175,728 | 100% |

| LESS: Sources of Funding includes £15.709m capitalisation direction | £78,951 | 49% | £89,037 | 51% |

| Council Tax Requirement excluding Parishes | £81,251 | 51% | £86,691 | 49% |

Budget Table

| 2024/25 Budget £000 | Services | 2024/25 Budget £000 |

|---|---|---|

| £42,203 | Adults Services | £46,855 |

| £11,989 | Children's Services | £12,037 |

| £36,791 | Slough Children First | £38,353 |

| £19,401 | Regeneration, Housing & Environment | £21,015 |

| £900 | Public Health & Public Protection | £1,302 |

| £6,068 | Chief Exec's Office | £2,800 |

| £1,916 | Law and Governance | £2,099 |

| £18,050 | Corporate Services | £14,894 |

| £22,884 | Corporate | £36,373 |

| £160,202 | Budget Requirement | £175,728 |

| (£78,951) | Other Sources of Finance (includes £15.709m capitalisation direction) | (£89,037) |

| £81,251 | Council Tax Requirement excluding Parishes | £86,691 |

| £193 | Local Parishes | £264 |

| £81,444 | Total Council Tax Requirement including Parishes | £86,955 |

How the Budget has changed

| Budget details | £000 |

|---|---|

| 2024/25 Budget (Restated) | £160,202 |

| Recognised cost pressures and sevice growth requirements | £27,500 |

| Savings | (£11,974) |

| 2025/26 Budget | £175,728 |

| Net increase in budget | £15,526 |

Payments made for levies and parish precepts

| Budget details | 2024/25 £000 |

2025/26 £000 |

|---|---|---|

| Environment agency for Flood Defence (Flood defence levy is included in the Regeneration, Housing and Environment budget). | £102.1 | £107.5 |

| Britwell Parish | £56.4 | £59.5 |

| Colnbrook with Poyle Parish | £93.6 | £93.6 |

| Wexham Court Parish | £42.8 | £110.7 |

The Council Tax booklet explains how we work out your council tax and where the money goes.

- Check the Council Tax booklet 2025-26.